Why Taxpayers Will Bail Out the Rich

When the Next Storm Hits

BY BILL DEDMAN

February 18, 2014

As homeowners around the nation protest skyrocketing premiums for federal flood insurance, the Federal Emergency Management Agency has quietly moved the lines on its flood maps to benefit hundreds of oceanfront condo buildings and million-dollar homes, according to an analysis of federal records by NBC News.

The changes shift the financial burden for the next destructive hurricane, tsunami or tropical storm onto the neighbors of these wealthy beach-dwellers — and ultimately onto all American taxpayers.

In more than 500 instances from the Gulf of Alaska to Bar Harbor, Maine, FEMA has remapped waterfront properties from the highest-risk flood zone, saving the owners as much as 97 percent on the premiums they pay into the financially strained National Flood Insurance Program.

NBC News also found that FEMA has redrawn maps even for properties that have repeatedly filed claims for flood losses from previous storms. At least some of the properties are on the secret "repetitive loss list" that FEMA sends to communities to alert them to problem properties. FEMA says that it does not factor in previous losses into its decisions on applications to redraw the flood zones.

And FEMA has given property owners a break even when the changes are opposed by the town hall official in charge of flood control. Although FEMA asks the local official to sign off on the map changes, it told NBC that its policy is to consider the applications even if the local expert opposes the change.

"If it's been flooded, it's susceptible to being flooded again. We all know that," said Larry A. Larson, director emeritus of the 15,000-member national Association of State Floodplain Managers. "FEMA is ignoring data that's readily available. That's not smart. And it puts taxpayer money at risk."

NBC NEWS

NBC NEWS

The Gulf Coast experience

The neighboring resorts of Gulf Shores and Orange Beach on the South Alabama coast include a stretch of beach that was flooded by Hurricanes Erin and Opal in 1995, Danny in 1997, Georges in 1998, Ivan in 2004, and Katrina in 2005. The map changes here offer a vivid example of the risks that come with such reclassifications.

The direct hit by Ivan was the worst, bringing not gently rising floodwaters but a 14-foot wall of water that leveled buildings and flooded more than a mile inland. That’s why flood maps show most of this beach as a "coastal velocity wave zone," the area with the highest risk of damage from storm surge.

But nearly all of the condominium towers are no longer in that highest-risk zone, including a 17-story condominium built where the old Holiday Inn was wiped away by Ivan’s winds and waves, and another where the McDonald's was a total loss. From 2011 through 2013, FEMA granted applications remapping 66 out of 72 waterfront condo towers in Gulf Shores to lower-risk flood zones or off the flood maps entirely. Four others have applications pending. Just two applications have been denied. And next door in Orange Beach, the map lines have been redrawn around four high-rise condo buildings.

On a single day, Oct. 25, 2012 — a day when FEMA was closely monitoring Hurricane Sandy as it barreled toward the Atlantic Coast — a FEMA manager issued a document reclassifying a full mile of the coastal property in Gulf Shores. That document, just one of the 533 cases found nationwide by NBC News, redrew the lines to exclude 25 condo buildings from the highest-risk flood zone.

This beachfront condo, the Island Tower, collected $11,562 for its damage from Katrina, and more than $250,000 from Ivan.

JOHN BRECHER / NBC NEWS

JOHN BRECHER / NBC NEWS

The Island Tower's condo association was paying $143,190 a year into the National Flood Insurance Program. Now that it's been reclassified into a lower-risk flood zone, its premium is $8,457 a year, a saving of 94 percent, according to records examined by NBC News.

Just down the beach is the Royal Palms. It collected $58,230 for damages during Katrina, and $889,730 from Ivan. The Royal Palms was paying $218,484 a year, but after being changed to a lower-risk flood zone, now pays only $6,845, saving 97 percent.

The map changes in just these two towns resulted in at least $5 million a year in lost revenue to the flood insurance program, according to records examined by NBC News. All of these changes were approved by FEMA despite opposition from the city officials in charge of floodplain management.

NBC NEWS

NBC NEWS

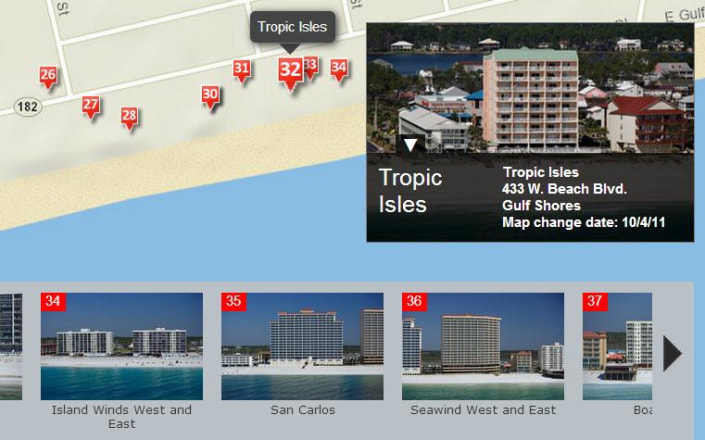

See a map from NBC News with details of the condominium projects in Gulf Shores and Ocean Beach. Some of the condo projects have multiple buildings, making more than 60 buildings in all.

Elsewhere in Gulf Shores, homeowners are paying as much as $12,000 a year in flood insurance premiums for their single-family homes, according to insurance records. These homeowners are paying as much as several large condo buildings combined.

Properties from Alaska to Maine

Because waterfront properties are expensive, and it costs thousands of dollars to hire an engineer to press a case with FEMA, the remapped properties tend to be luxurious, either the first or second homes of industrialists, real estate developers and orthopedic surgeons.

The 533 properties include a $4 million home in the Hamptons resort on Long Island, N.Y., owned by a married couple who direct Wall Street investment firms.

In Miami, the beneficiaries include the twin 37-story condos at ritzy Turnberry Islein Sunny Isles Beach, and also the Regalia, "the most luxurious building in South Florida."

COURTESY OF PICTOMETRY INTERNATIONAL CORP.

COURTESY OF PICTOMETRY INTERNATIONAL CORP.

In Naples, Fla., a $19 million home was remapped last year out of the highest-risk zone. The owner, Robert A. Watson, former president and CEO of units of Westinghouse Electric and Transamerica, said his property is protected by a floodwall, and he sought the map change last year not to save money but because FEMA has changed the map elevations in that area so many times. He said he wanted to know for sure that a guesthouse would be permitted. (He called mandatory flood insurance "a massive scam on the American people.")

In New York, FEMA granted the Mamaroneck Beach & Yacht Club's request to be remapped from the highest-risk flood zone in August 2012 — just two months before the club was damaged and its outbuildings destroyed by Hurricane Sandy, which stacked up yachts at its docks like pick-up sticks. The club told NBC that its engineering study showed that FEMA's map was wrong.

"Sandy was a once in a millennium event, and therefore cannot be the sole determination for planning," said Eric L. Gordon, attorney for the yacht club.

On North Carolina's Hatteras Island, the Frisco section was swamped by Hurricane Isabel in 2003. The storm produced a new body of water, Isabel Inlet, isolating the island for months. An entire neighborhood, flooded then, wasremapped in 2011 by FEMA out of the highest-risk flood zone.

Number of changes more than doubled last year

These map changes were rare until the mid-2000s, but their numbers have skyrocketed in recent years. We found a handful of cases each year in the early 2000s, then 44 cases in 2008, 68 in 2009, 90 in 2010, 87 in 2011, 68 in 2012, and 152 in 2013. The true number of flood map changes is probably far higher than our count of 533. We were able to examine documents for only about half of FEMA's map changes in coastal states, because searchable documents were not available on the FEMA website. And our count excluded thousands of map changes each year near rivers and streams.

On the Pacific Coast, where the hurricane threat is lower but tsunamis are a risk,dozens of properties on Puget Sound have benefitted from map changes. Though low-lying Florida, with the most flood zone properties, has the most cases that NBC documented, with 124, Washington state was a close second with 116, followed by Maine (79), California (35) and Massachusetts (35). We were able to confirm map changes in every coastal state except New Hampshire, with its tiny shoreline, and Louisiana, where most of the coastline is marsh, and where Katrina's high waves set a new bar for flood maps, overriding previous map changes.

JOHN BRECHER / NBC NEWS

JOHN BRECHER / NBC NEWS

FEMA reviewing cases identified by NBC

Although FEMA would not make any official available for an interview on the record, spokesman Dan Watson issued this statement: "In order to ensure the public knows their flood risk and insurance is priced accurately, FEMA works with communities and property owners to incorporate the best available data into the nation’s flood maps. Individuals can request amendments and changes to the maps, but those requests must meet regulatory as well as scientifically established, technical requirements. ... FEMA has no tolerance for fraud and we refer any allegations or suspicions of fraud to the Department of Homeland Security’s Inspector General."

Property owners send their applications for map changes along with measurements and elevation data certified by an engineer or surveyor. These are evaluated by contractors for FEMA, which then issues the letter approving or denying the changes. Although the contractors do most of the work, FEMA said it has auditing procedures to check a random sample of the work done by its contractors.

"FEMA takes its responsibility for administering the National Flood Insurance Program seriously and is reviewing the cases presented by NBC to ensure they were properly processed," Watson said in the statement. "FEMA strives to ensure that administrative actions are properly executed and meet all statutory and regulatory mandates. The data provided by applicants for LOMAs (letters of map amendment) and LOMRs (letters of map revision) are reviewed based on scientific, technical standards and approved or denied based on those standards. FEMA has monitoring, oversight, and audit processes in place to ensure the work performed by contractors follows proper procedures."

If you're remapped, will the next hurricane care?

At town hall meetings around the country in recent months, homeowners have cried out about sharply higher premiums for flood insurance or the inclusion of their properties in the program for the first time. New flood maps in many states have raised the estimation of flood risks along rivers, streams and oceans, adding many properties to flood zones for the first time. And now, as changes are phased in from a law called the Biggert-Waters Flood Insurance Reform Act of 2012, owners are facing sticker shock as they pay their "fair share" according to their risk of flooding.

Meantime, with little public notice, FEMA has been changing the flood maps to give others a break. Last year, FEMA says, it approved 89 percent of the applications for map amendments. Carving the flood zone map like a parent cutting a notch in a jack-o'-lantern to make a tooth, FEMA moves the lines on a map for one property, while leaving its neighbors in the highest-risk zone. In some cases FEMA not only moves the properties down a step in risk, which would save those owners on their insurance premiums, but moves them all the way down to the lowest-risk zone, making flood insurance optional.

Although the map changes are required to be made public, they receive little attention. The action reclassifying a mile of the Gulf Shores beach got the standard treatment: a line in the Federal Register showing a case number, and a tiny classified ad in the community newspaper.

Although the map changes are required to be made public, they receive little attention. The action reclassifying a mile of the Gulf Shores beach got the standard treatment: a line in the Federal Register showing a case number, and a tiny classified ad in the community newspaper.

Giving property owners a method for correcting errors on flood maps is perfectly reasonable, according to national specialists in flood insurance. But considering coastal properties with a history of flooding as low risk has inevitable results, they say:

- The owners pay less into the national flood insurance program, where a reduced risk typically means a lower premium. Depending on when the map change is issued, the owners may receive refunds of premiums for the current year and the previous year.

- If these properties are damaged in the next hurricane, nor'easter or tsunami, they're still insured by the national flood program, up to $250,000 in damage to a single-family home, or $250,000 per unit for a condo building, which could add up to $100 million for a high-rise with 400 units.

- The American taxpayer gets the bill when the National Flood Insurance Program runs out of cash. The program currently has a deficit of $24 billion, FEMA says.

- Being in a less-restrictive flood zone allows owners to use lower construction standards, avoiding breakaway walls and sinking piers and pilings deep into the ground. Such shortcuts encourage overbuilding along the coastline, further increasing the risk to taxpayers.

One prominent insurance consultant, Bruce A. Bender of Arizona, said that many map changes may be perfectly justified. A surveyor may find a higher elevation, for example, than FEMA had estimated. An unjustified map change, however, "impacts how people build," Bender said. "For example, if you put a new building in a Zone A," which doesn't anticipate strong waves, "that really has a higher risk due to potential heavy wave damage and should be in a Zone V, you should be putting in breakaway walls. Homes have a greater chance of getting damaged or wiped out."

Coming Wednesday, part two: The "Robin Hood" who can get properties a break on the flood maps.

Share your information

Do you have information on FEMA's changes to flood maps, or the companies that apply for or evaluate these applications? Send an email to investigative reporter Bill Dedman at NBC News.

About the public records

NBC News requested from FEMA the public records of all active changes to its flood maps, called letters of map revision (LOMR) or letters of map amendment (LOMA). We received databases with short descriptions of 307,730 of these changes since the 1970s. Limiting our search to 23 states on the Pacific, Gulf and Atlantic coasts, NBC downloaded all the available PDFs of the public records for those map changes from FEMA's website. NBC News investigative reporter Bill Dedman and database consultant Richard Mullins examined the public records, evaluating determining whether any part of a coastal property changed from the highest-risk flood zone (a coastal high-hazard area, defined as Zone V on FEMA flood maps) to a lower zone. Only changes from this highest classification were counted — most of the properties received revisions from, say, a mid-risk flood zone to the lowest-risk zone. The actual number of map changes from high-risk zones is apparently far higher than the 533 we counted; more than half of the FEMA documents did not have searchable text or no document could be found under that case number on FEMA's website.

No comments:

Post a Comment